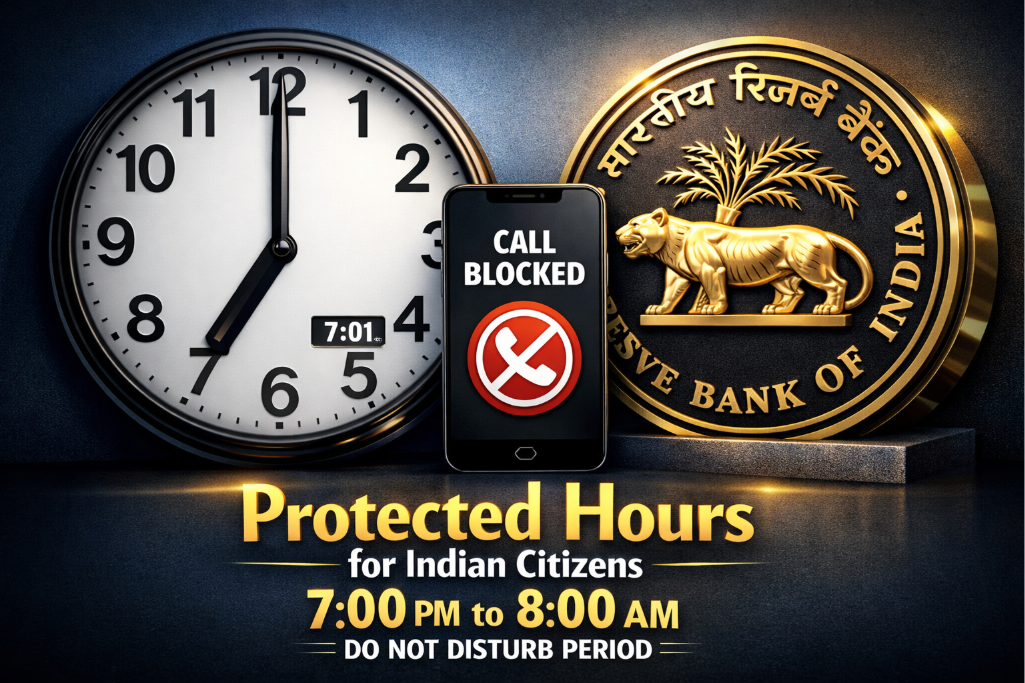

On February 12, 2026, the Reserve Bank of India (RBI) issued the (Commercial Banks – Responsible Business Conduct) Second Amendment Directions, 2026, a landmark draft aimed at ending aggressive debt collection. With these new rules slated to take effect from July 1, 2026, the central bank is drawing a hard line in the sand: your right to privacy and dignity is now as critical as the bank’s right to its money.

The Market Gap: Ending the Era of “Collection via Coercion”

For years, a significant gap existed in the Indian credit market: while digital lending scaled at breakneck speed, the recovery mechanism remained archaic and often predatory. Borrowers frequently reported “midnight panic calls” and social shaming by third-party agents. The 2026 RBI directive addresses this by formalizing responsible lending conduct, ensuring that financial stress does not translate into physical or mental harassment for the Aam Aadmi.

The Unit Economics: Old Recovery vs. 2026 Compliance

The transition from unregulated recovery to the new “Responsible Conduct” framework forces banks to internalize the cost of ethical collection.

| Recovery Feature | Old Framework (Pre-2026) | New RBI Mandate (Effective July 1, 2026) | Impact on Borrower |

| Permissible Calling Hours | Often unregulated/Late night | 08:00 to 19:00 (8 AM to 7 PM) | Guaranteed mental peace after 7 PM |

| Third-Party Contact | Relatives/Friends/Co-workers | Borrower or Guarantor ONLY | Protection of social reputation |

| Occasion Sensitivity | No specific bans | No calls during bereavement/marriages | Respect for personal calamity |

| Agent Identification | Vague or anonymous calls | Mandatory ID & Prior SMS/Notice | Elimination of “Digital Arrest” scams |

The “ForgeUp” Strategic Audit: Accountability and the “July 1” Deadline

While these rules are a victory for consumer rights, the ForgeUp audit suggests businesses and lenders must prepare for a radical shift in “Collection Efficiency.”

- The Accountability Pivot: Banks can no longer hide behind third-party agencies. The RBI has made it clear that the Regulated Entity (RE) is solely responsible for any misconduct by its agents.

- The Digital Trail: Under the 2026 rules, all recovery calls must be recorded, and banks must maintain a dedicated mechanism for redressal of recovery-related grievances.

- The Risk of “Strategic Default”: Analysts at ICICI and HDFC warn that while protection is necessary, strict calling windows might slow down recovery for genuine willful defaulters. However, the RBI has balanced this by allowing banks to visit residences if the borrower fails to show up at “designated collection points” for microfinance.

Also Read: Indian Stock Market Crash: Why “Anthropic Shock” and IT Rout Wiped Out ₹4 Lakh Crore

FAQ / People Also Ask

- What should I do if a recovery agent calls me after 7 PM?Record the call, note the time, and immediately lodge a complaint with the bank’s Grievance Redressal Officer. If the bank doesn’t resolve it within 30 days, escalate it to the RBI Ombudsman.

- Can a bank agent call my employer or neighbors?No. The 2026 guidelines strictly prohibit approaching relatives, friends, or co-workers. Interacting with anyone other than the borrower or guarantor is now classified as a “harsh method.”

- Are these rules applicable to NBFCs and Fintech Apps?Yes. The draft directions extend to all Regulated Entities (REs), including Small Finance Banks, NBFCs, and co-operative banks.

The Founder’s Playbook: Managing Debt Responsibly

- Document Everything: If you are facing financial hardship, proactively email your bank before they call. A written record of your intent to pay is your strongest defense against “willful defaulter” labels.

- Know the ID: Always demand the agent’s Authorization Letter and ID card before discussing your debt. If they cannot produce it, they are in violation of RBI norms.

- Use the “Request-to-Avoid” Rule: Under the 2026 norms, if you request a bank to avoid calling at a specific time (e.g., during office hours), they must honor it in normal circumstances.

The Bottom Line

- Human-Centric Recovery: The 7 PM cut-off turns debt recovery into a professional financial process rather than a psychological battle.

- Zero-Tolerance for Harassment: Abusive language, social media shaming, and anonymous threats are now punishable offenses for the bank.

- Transparency First: By July 1, 2026, every bank must publish its list of empanelled recovery agents on its website, ensuring no rogue actors can operate in the shadows.