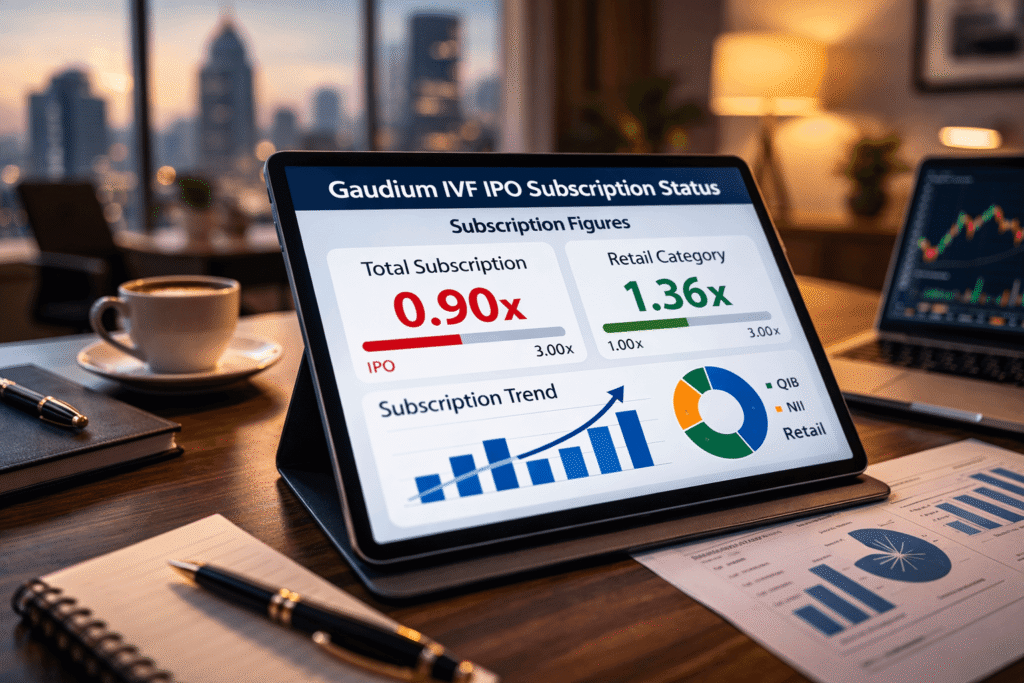

Synopsis: Gaudium IVF and Women Health Ltd saw a steady start on its opening day, February 20, 2026, reaching an overall subscription of 0.90 times. While institutional activity remained muted, retail investors led the momentum, fully booking their reserved portion within the first few hours of the issue.

The ₹165 crore initial public offering (IPO) of Gaudium IVF and Women Health Limited opened for public bidding today, receiving a healthy response from the broader market. According to consolidated exchange data from the NSE and BSE, the issue received bids for 1.27 crore equity shares against an offer size of 1.46 crore shares (excluding the anchor portion).

Retail Investors Take the Lead

The highlight of Day 1 was the aggressive participation from retail individual investors. The portion reserved for this category was subscribed 1.36 times, indicating a strong appetite for India’s first pure-play listed fertility services provider.

- Non-Institutional Investors (NII): The segment saw a subscription of 0.90 times, with High-Net-Worth Individuals (HNIs) showing steady interest.

- Qualified Institutional Buyers (QIB): As is typical for the first day of bidding, the QIB portion saw negligible activity (0.00x), with institutional bids expected to pick up on the final day.

Earlier, the company successfully raised ₹49.50 crore from marquee anchor investors at the upper price band of ₹79 per share.

Grey Market Signals and Financial Outlook

The Grey Market Premium (GMP) for Gaudium IVF is currently hovering around ₹8.50, suggesting a potential listing price of ₹87.50. This indicates an estimated listing gain of approximately 10.76%. While the GMP has slightly cooled from its pre-IPO highs of ₹15, the healthy retail subscription suggests a positive debut on February 27.

The company plans to utilize ₹50 crore from the fresh issue proceeds to establish 19 new IVF centers across India. With an EBITDA margin of 40% in FY25, the company’s financial health remains a key attraction for investors, despite a noted ₹31 crore tax dispute currently under litigation.

Bidding Timeline

The IPO will remain open until February 24, 2026. Investors can bid in lots of 189 shares, requiring a minimum investment of ₹14,931 at the upper price band.

Disclaimer: The views expressed are for informational purposes only and do not constitute financial advice. Investing in stocks and IPOs involves significant risk. forgeup.in is not liable for any financial losses. Always consult a certified investment advisor before making any decisions.