Synopsis: Clean Max Enviro Energy Solutions Ltd, India’s largest C&I renewable energy provider, opened its ₹3,100 crore Initial Public Offering (IPO) for subscription today, February 23, 2026. With a price band of ₹1,000–₹1,053, the issue is a strategic play for investors looking to tap into the corporate green energy transition.

Clean Max Enviro Energy Solutions, a Brookfield-backed powerhouse, has entered the primary market with a significant mandate to deleverage and expand. The IPO, which remains open until February 25, 2026, marks a pivotal moment for the Business-to-Business (B2B) renewable sector, specifically targeting the commercial and industrial (C&I) segment.

Issue Details and Bidding Structure

The ₹3,100 crore issue is a blend of a fresh issuance worth ₹1,200 crore and an Offer for Sale (OFS) of ₹1,900 crore. Notably, the company has scaled down the issue size from its initial ₹5,200 crore target, reflecting a more calibrated approach in the current market.

- Price Band: ₹1,000 to ₹1,053 per equity share.

- Lot Size: 14 shares (Minimum investment of ₹14,742 for retail).

- Reservation: 50% for QIBs, 35% for Retail, and 15% for Non-Institutional Investors (NII).

- Employee Discount: Eligible employees receive a ₹100 per share discount.

Why the Grey Market Remains Muted

As of Day 1, the Grey Market Premium (GMP) for Clean Max Enviro is hovering near ₹7 to ₹9, suggesting a flat to modest listing gain of approximately 0.85%. Analysts attribute this conservative sentiment to the company’s aggressive valuation—trading at a P/E multiple exceeding 600x based on FY25 earnings. While EBITDA margins are exceptional at 63%, the high debt-to-equity ratio remains a point of scrutiny for short-term traders.

Financial Strength and Growth Catalysts

Clean Max has successfully turned profitable in FY25, reporting a Net Profit of ₹19.43 crore compared to a loss of ₹37.64 crore in FY24. The company’s “subscription-like” revenue model is built on long-term Power Purchase Agreements (PPAs) with a weighted average tenure of 22.8 years.

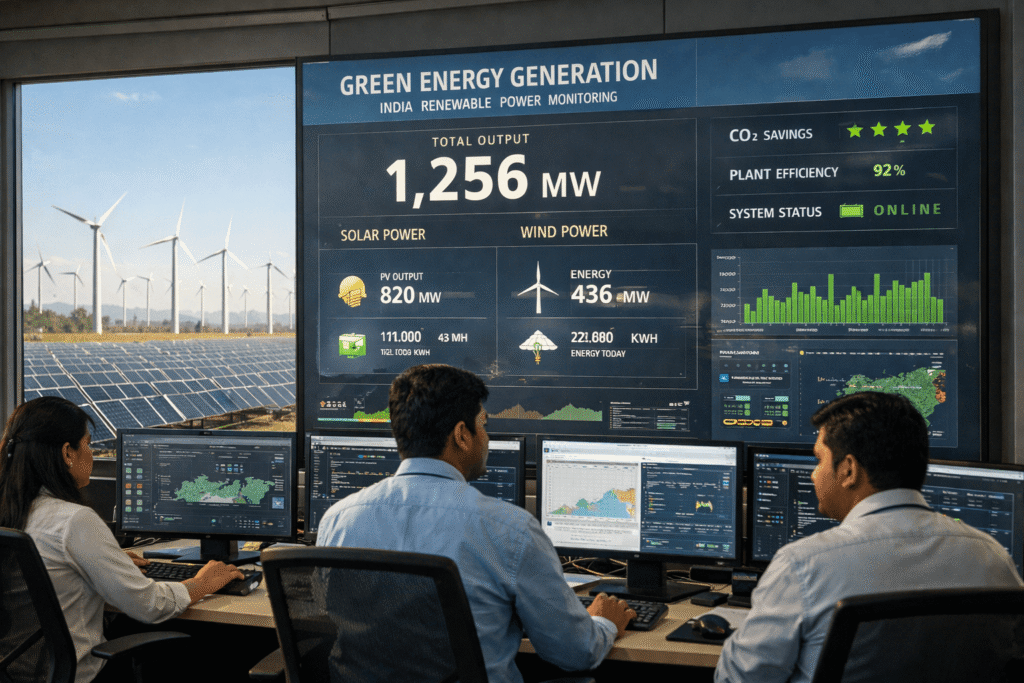

- Operational Scale: 2.54 GW of operational capacity as of July 2025.

- Pipeline: An additional 2.53 GW currently under execution.

- Debt Reduction: Nearly 93% of the fresh issue proceeds (₹1,122.6 crore) will be used to repay outstanding borrowings, which stood at over ₹10,000 crore as of September 2025.

Also Read: Clean Max Enviro Energy Solutions IPO: How to Invest in India’s Largest C&I Renewable Leader?

The AI and Data Center Edge

A major growth engine for Clean Max is the rising demand from technology giants. Data centers and AI-driven infrastructure now account for approximately 43% of the company’s contracted capacity. This niche positioning separates Clean Max from traditional power utilities, making it a “decarbonization partner” for global MNCs like Amazon and Google.

Disclaimer: The views expressed are for informational purposes only and do not constitute financial advice. Investing in stocks and IPOs involves significant risk. forgeup.in is not liable for any financial losses. Always consult a certified investment advisor before making any decisions.