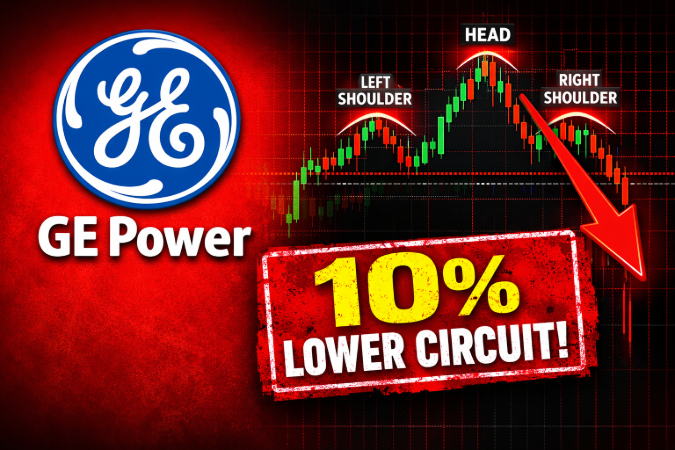

Synopsis: GE Power India Ltd (NSE: GEPIL) shares hit a 10% lower circuit at ₹496.85 on February 18, 2026. The “Zero-Minute” fact is that after a meteoric 66% rally in just four days, the stock faced aggressive profit booking, further pressured by its recent addition to the SEBI ASM (Additional Surveillance Measure) framework.

On Wednesday, February 18, 2026, GE Power India Limited witnessed a sharp reversal in its market trajectory, with its stock price locked at the 10% lower circuit limit of ₹496.85. This plunge effectively ended a four-day winning streak where the stock had touched a 19-month high of ₹552.05. The heavy selling pressure resulted in nearly 39 lakh shares being traded, but a significant “unfilled supply” remained at the circuit floor as buyers disappeared.

The stock’s decline comes despite its recent Q3 FY26 turnaround, where it reported a net profit of ₹72.32 crore. However, market participants are now weighing the recent 60-65% gains against emerging technical and regulatory headwinds.

Why did GE Power India stock fall today?

The primary driver of the crash is Aggressive Profit Booking. The stock had gained nearly 66% between February 11 and February 17, driven by a “debt-free” status and stellar earnings. Such vertical rallies often lead to a “blow-off top” where short-term traders exit their positions simultaneously, triggering panic selling among retail investors.

Furthermore, the “1-2-1” rule of today’s decline was evident: one major regulatory trigger (ASM Framework), two structural concerns (shrinking order book and regulatory shifts), and one technical reversal.

Key Factors Behind the 10% Fall:

- ASM Framework Addition: The stock was added to the Additional Surveillance Measure (ASM) framework on February 16. Stocks under ASM face higher margin requirements and stricter trading rules, often prompting institutional and retail traders to reduce their exposure to manage risk.

- Technical Overextension: Prior to today, the Relative Strength Index (RSI) had surged above 70, signaling deep overbought conditions. A correction was technically “due” to bring the price back in line with its moving averages.

- Order Book Erosion: While earnings were strong, the order backlog has shrunk by 38.3% YoY to ₹1,670.6 crore. This contraction—driven by the termination of two major FGD (Flue Gas Desulphurization) contracts worth ₹775 crore—casts a shadow on long-term revenue sustainability.

GE Power India: Intraday Metrics (Feb 18, 2026)

| Metric | Value | Change (%) |

| Current Market Price | ₹496.85 | 10.00% ↓ |

| Previous Close | ₹552.05 | – |

| Intraday Volatility | 5.25% | High |

| Mojo Score | 57.0 | Hold Grade |

The “Analytical Bear Case”

Despite the immediate crash, the stock remains above its key moving averages, suggesting the long-term trend isn’t broken yet.

- Fundamental Reality: Management is banking on a 2.5% acceleration in 2026 driven by industrial recovery. However, the loss of FGD contracts due to changing environmental notifications remains a structural headwind for the thermal power segment.

- Small-Cap Volatility: As a small-cap entity with a market value near ₹3,300 crore, GEPIL is prone to sharper swings. The current P/E is trending higher than the sector average, making the valuation “expensive” for new entries at recent peaks.

The Bottom Line

The 10% lower circuit in GE Power India is a classic “cooling off” period following a massive speculative rally. For the Aam Aadmi investor, the focus remains on the ₹480 support level. If the order book shrinkage isn’t addressed with fresh domestic wins from NTPC or BHEL, the current “earnings euphoria” may struggle to sustain further rallies.