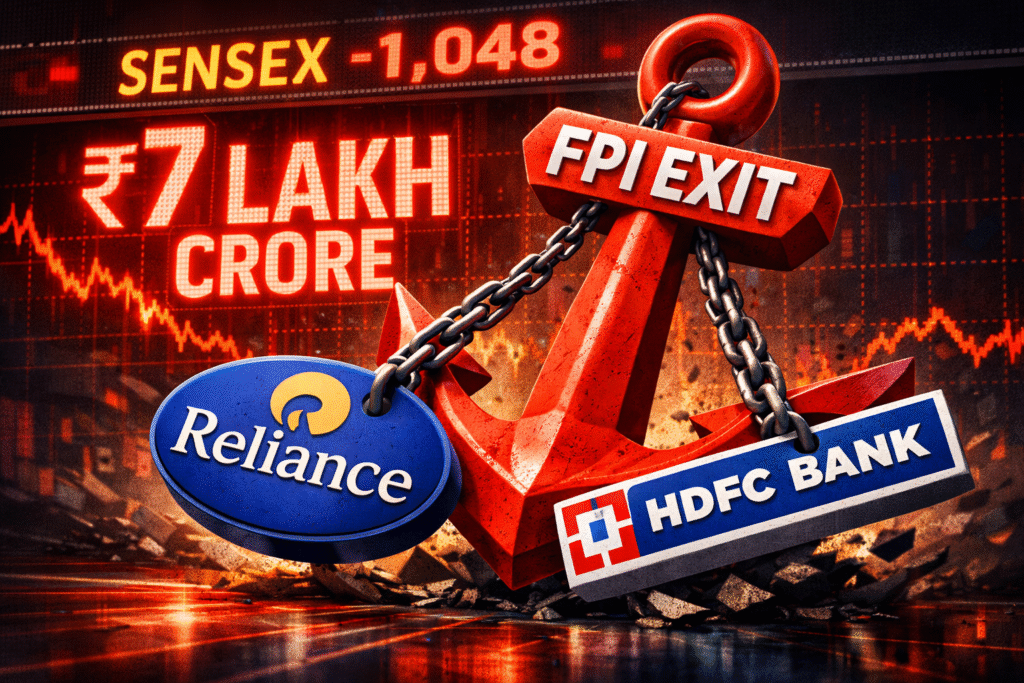

Synopsis: Heavyweights HDFC Bank (NSE: HDFCBANK) and Reliance Industries (NSE: RELIANCE) spearheaded a brutal market sell-off on February 13-15, 2026, as investors grappled with a ₹7.02 Lakh Crore wipeout in total market capitalization. The panic was triggered by a massive ₹7,395 Crore FPI exit, the “Anthropic Shock” disrupting the tech sector, and stronger-than-expected US jobs data crushing hopes for interest rate cuts.

On February 15, 2026, the Indian equity markets continued to feel the aftershocks of a “Friday the 13th” bloodbath that saw the Sensex plunge 1,048 points to settle at 82,626. Reliance Industries and HDFC Bank, the two most influential pillars of Dalal Street, were among the primary laggards, contributing heavily to the systemic decline. The broader Nifty 50 slipped below the critical 25,500 support level, as a “perfect storm” of global and domestic headwinds forced institutional investors into a massive de-risking mode.

The market capitalization of all BSE-listed firms slumped to approximately ₹465 Lakh Crore, down from ₹472 Lakh Crore just 48 hours prior. This aggressive sell-off has wiped out the gains of the last two weeks, leaving retail investors staring at a sea of red as the Nifty IT and Metal indices bore the brunt of the institutional exit.

Why are HDFC Bank and Reliance stock falling?

The primary driver of the crash is the massive FPI Sell-off. Foreign Portfolio Investors offloaded equities worth ₹7,395.41 Crore in a single session, their highest single-day exit in months. This was fueled by a spike in the US 10-year Treasury yield following robust US employment data, which reinforced “higher-for-longer” rate fears. For HDFC Bank, which is a favorite among foreign funds, this translated into direct downward pressure on its ADRs, which spilled over into the domestic cash market.

For Reliance Industries, the pressure stems from a combination of “margin caution” in its O2C (Oil-to-Chemicals) segment and a broader rotation out of large-cap heavyweights. As the US Dollar Index (DXY) strengthened to 96.93, the Indian Rupee weakened to 90.67, making Indian assets less attractive for global carry trades. The 1-2-1 rule of market sentiment was evident: one major AI disruption trigger, two macro-economic headwinds, and one massive institutional liquidation.

Market Meltdown: HDFC Bank & Reliance Performance

| Stock / Index | Price Fall (Weekly) | Wealth Loss (Approx.) | Key Trigger |

| Reliance Industries | 2.13% ↓ | ₹42,000 Cr | Profit Booking / FPI Exit |

| HDFC Bank | 3.77% ↓ | ₹34,000 Cr | Technical Breakdown / ADR Slide |

| Nifty 50 Index | 1.30% ↓ | ₹7.02 Lakh Cr (Total) | US Rate Hikes & AI Shock |

The “Analyst Consensus” on the Market Panic

Top brokerages are advising a “defensive stance” as the market enters a turbulent phase of price discovery.

- Geojit Financial Services: Dr. V.K. Vijayakumar stated that the “Anthropic shock” is rattling the profit pools of India Inc., and until the impact on IT services is quantified, heavyweights like Reliance and HDFC Bank will face collateral selling as funds exit the country.

- Enrich Money: Analysts highlight that the Nifty 50 has broken its 25,900 support, with the RSI hovering in the mid-50s, suggesting neutral-to-bearish momentum without immediate signs of a bottom.

- Technical Outlook: Chartists at MarketsMojo have downgraded HDFC Bank to a “Sell,” citing deteriorating MACD indicators and flat financial results that failed to inspire confidence during the volatility.

Also Read: RBI’s 7-Day Credit Reporting Mandate: Why Your CIBIL Score is Moving to “Fast-Forward” in 2026

The Bottom Line

The ₹3 Lakh Crore erosion in Reliance and HDFC Bank wealth is a stark reminder of India’s sensitivity to global liquidity shifts. For the Aam Aadmi investor, the focus must remain on the US CPI data release and the upcoming Union Budget 2026 implementation to see if domestic triggers can offset the FPI exodus.