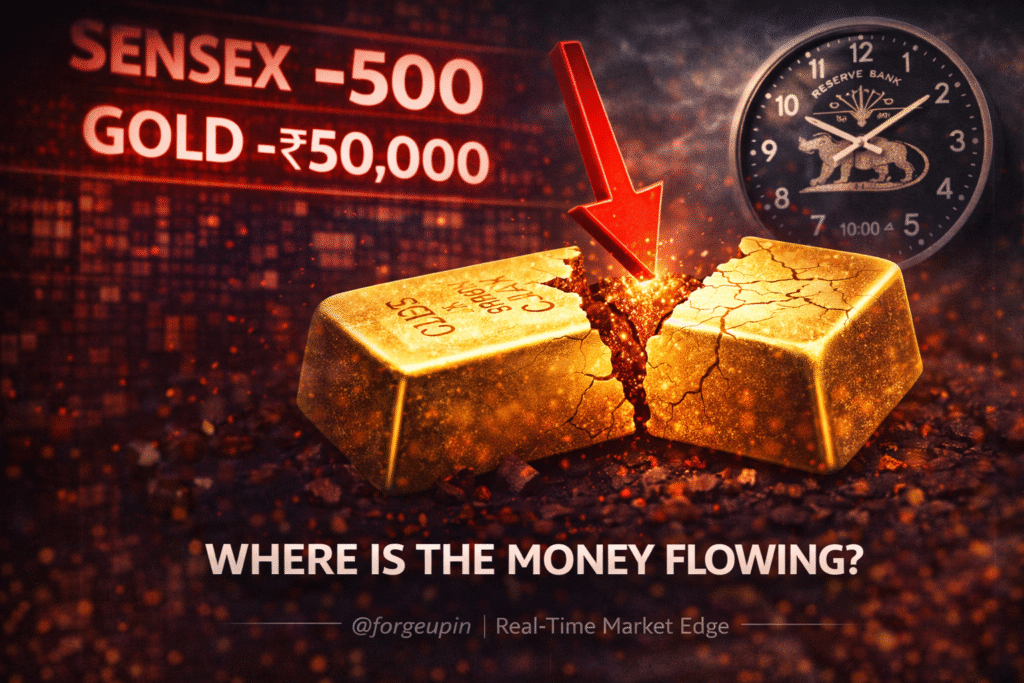

If you were holding onto your gold jewelry or “safe-haven” stocks today, you just witnessed a ₹50,200 wipeout. The truth is, the market’s “Post-Budget” honeymoon ended abruptly on February 5, 2026, as a “Perfect Storm” from Washington met the “Final Countdown” of the RBI in Mumbai, leaving the Common Man investor scrambling for cover.

The Shocking Crash: Why Gold Lost ₹50,200 per 100g

The morning of February 5 saw a brutal reversal for the yellow metal. After a two-day rally, 24K Gold prices crashed by ₹5,020 per 10 grams, bringing the price down to ₹1,54,420. For those holding bulk, the 100-gram rate plummeted by a staggering ₹50,200.

Why the sudden collapse? Here is the catch: it’s the “Warsh Effect.” US President Donald Trump nominated Kevin Warsh as the next Fed Chair. Warsh is a known “inflation hawk” who favors a smaller Fed balance sheet. This sent the US Dollar soaring, making non-yielding assets like Gold look like a “liability” overnight.

The Bullion Bloodbath: Yesterday vs. Today (Feb 5, 2026)

| Metal Type | Price (Feb 4, 2026) | Price (Feb 5, 2026) | Single Day Crash |

| 24K Gold (10g) | ₹1,59,440 | ₹1,54,420 | -₹5,020 |

| 24K Gold (100g) | ₹15,94,400 | ₹15,44,200 | -₹50,200 |

| 22K Gold (10g) | ₹1,46,150 | ₹1,41,550 | -₹4,600 |

| Silver (1kg) | ₹2,69,500 | ₹2,42,000 | -₹27,500 (10%) |

How the RBI’s “Final Countdown” Triggered the 500-Point Sell-Off

While Gold was crashing, the equity markets weren’t spared. The Sensex dropped over 500 points to close at 83,305, while the Nifty slipped below the 25,650 support level. This is the “Final Countdown”—the 24-hour window before RBI Governor Sanjay Malhotra announces the first major monetary policy of 2026.

1. The “Status Quo” Nightmare

The market is terrified that the RBI will maintain a “Status Quo” on interest rates tomorrow (Feb 6). With the India-US trade deal already boosting the Rupee and the Budget providing a growth cushion, analysts fear the RBI will see no reason to cut the repo rate from 5.25%.

2. The Metal Sector Melt-Down

The global drop in commodity prices (led by the stronger Dollar) hit Indian metal stocks like a ton of bricks. Hindalco and Tata Steel fell nearly 4%, dragging the entire Nifty Metal index down by 2%.

3. Profit Booking in “Deal-Maker” Stocks

The euphoria from the 18% Trump Tariff move earlier this week saw massive profit-booking. Investors who made 20% gains in three days on Textile and Shrimp stocks decided to “cash out” ahead of the RBI’s uncertainty.

What the Analysts are Saying

Market sentiment has turned “Cautiously Bearish” ahead of the Friday morning speech.

- Geojit Financial Services (V.K. Vijayakumar): “The market is in a consolidation phase. The sharp 500-point drop is a classic pre-policy shakedown where weak hands are being forced out before the RBI’s verdict.”

- Enrich Money (Ponmudi R): “Gold is seeing healthy consolidation. While today’s ₹50,000 drop per 100g looks scary, the broader bullish structure remains intact as long as it holds the ₹1,45,000-per-10g support.”

- The Consensus: The “Warsh” nomination has changed the global liquidity map. If the RBI turns hawkish tomorrow, we could see Nifty testing 25,400.

Pro-Tip: The “Silver Lining”

Silver took an even bigger beating than gold today, crashing 10% to hit the ₹2.42 Lakh mark. Historically, such “flash crashes” in silver precede a sharp V-shaped recovery. If you are a long-term investor, this 10% dip is a “Secret Blueprint” for accumulation.

The Bottom Line

The ₹50,200 Gold crash and the 500-point Sensex slide are clear warnings: the global market is repricing for a “Hawkish” US Fed and a “Stubborn” RBI. For the Retail Investor, today was a reminder that even in a bull market, taxes and policy can wipe out weeks of gains in hours. Keep your eyes glued to the RBI Governor’s speech at 10:00 AM tomorrow.