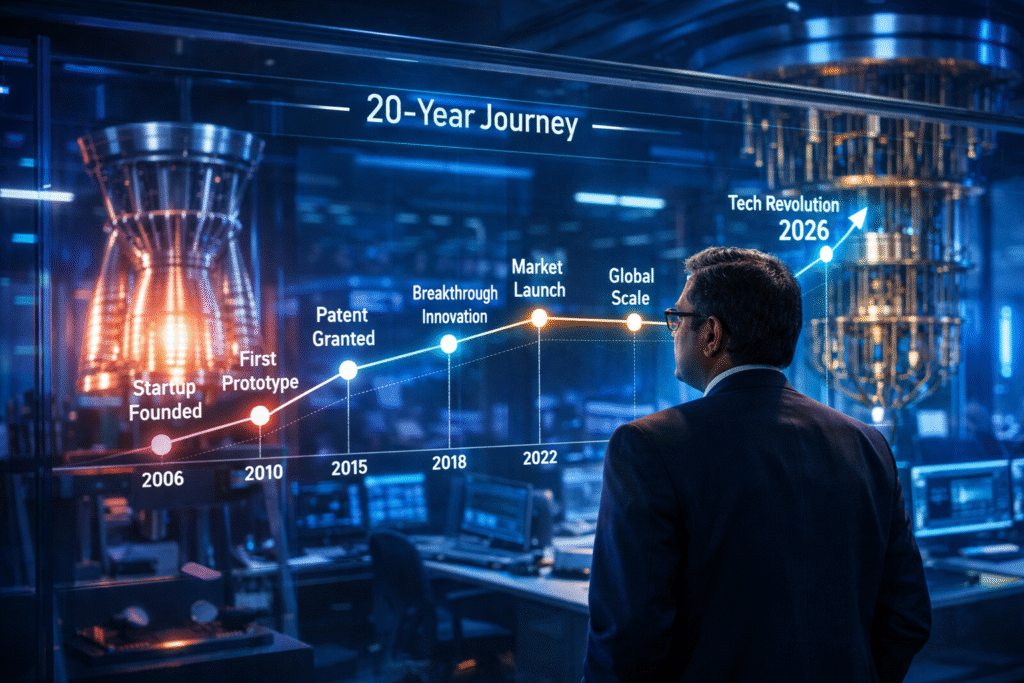

In 2018, an Indian deep-tech startup building satellite propulsion systems was 24 hours away from losing its “Startup” status because it hit its 7th year without hitting mass revenue. Fast forward to February 2026, and that same company is now a ₹1,200 Crore global leader, thanks to a radical policy shift.

On February 4, 2026, the Department for Promotion of Industry and Internal Trade (DPIIT) issued a historic gazette notification. For the first time, India has officially decoupled “Deep-Tech” from regular startups, granting them a 20-year recognition window and a massive ₹300 Crore turnover cap. This isn’t just a regulatory update; it is the construction of a “Silicon Runway” designed to protect India’s most ambitious scientists from the “Valley of Death.”

The Problem: The “10-Year Death Sentence”

The ground reality was that science-led businesses—those working on semiconductors, quantum computing, or biotech—were being treated like food-delivery apps. Traditional Startup India rules gave companies only 10 years to “make it” before they lost tax benefits and government procurement access.

Against all odds, deep-tech founders were forced to commercialize prematurely. Research-heavy firms often spend 7 to 8 years in a lab before earning their first Rupee. Losing startup status just as they entered clinical trials or space-readiness tests meant they were hit with “Angel Tax” and lost access to the ₹1 Lakh Crore R&D Innovation Fund exactly when they needed it most.

The Pivot/Strategy: Defining the “Deep-Tech” Moat

The 2026 framework introduces a separate regulatory category. To qualify for the 20-year benefits, a startup must prove it isn’t just “using” tech, but “inventing” it.

The “Deep-Tech” Criteria:

- R&D Intensity: A significant percentage of revenue or funding must be dedicated to research.

- IP Ownership: The entity must own—or be developing—novel Intellectual Property (IP).

- Scientific Uncertainty: The solution must be based on new scientific or engineering knowledge that carries high technical risk.

By raising the turnover cap to ₹300 Crore (compared to ₹200 Crore for regular startups), the government is allowing these “Micro-Unicorns” to scale their first few massive government or defense contracts without losing their “Small Business” protection.

The Unit Economics: The “Patient Capital” Advantage

| Metric | General Startup (E-commerce/SaaS) | Deep-Tech Startup (2026 Framework) |

| Recognition Period | 10 Years | 20 Years |

| Turnover Cap | ₹200 Crore | ₹300 Crore |

| Gestation Period | 1 – 3 Years | 7 – 12 Years |

| Tax Holiday (80-IAC) | 3 Years (within first 10) | Extended Window (within 20) |

| Govt. Procurement | Standard EMD Waivers | High-Priority “Drone Shakti” & Space |

The “ForgeUp” Analysis: The Rise of the “IP-First” Founder

From a venture studio perspective, this policy shift de-risks the most “un-investable” sector. Previously, VCs were hesitant to back a 15-year moonshot. Now, with 20 years of regulatory stability, “Patient Capital” from family offices and pension funds is finally flowing into Indian labs.

This creates a massive opportunity for the Micro-Unicorn. You can now build a highly specialized, low-staff, high-IP business that dominates a global niche—like EV battery chemistry or 6G components—knowing that the Indian government will support you as a “startup” until your technology is globally mature.

Expert Consensus: What the Industry Says

“The earlier 10-year framework often expired before deep-tech companies became commercially viable. We were losing startup status just as we approached the market.” — Sateesh Andra, MD of Endiya Partners.

“This change unlocks a meaningful pool of domestic capital. It removes the structural bottleneck that kept high-quality science firms out of the investable framework.” — Anirudh A. Damani, Artha Venture Fund.

💡 Founder’s Playbook: Navigating the 20-Year Runway

- Document Every R&D Rupee: The DPIIT now requires additional proof of R&D intensity. Use automated tools to track every hour spent on IP creation.

- Avoid “Non-Core” Investments: The new 2026 rules strictly bar recognized startups from investing in residential real estate or speculative assets. Keep your funds in R&D or core operations.

- Focus on TRL (Technology Readiness Levels): The ₹1 Lakh Crore R&D Fund prioritizes startups at TRL 4 and above. Get your lab-scale validation done early to unlock state-backed grants.

The Bottom Line

The 2026 expansion of Startup India marks the end of the “Copy-Paste” startup era. By giving deep-tech firms double the time and 50% more revenue headroom, India is finally allowing its geniuses to be patient. If you are building the future of humanity in a lab, the government has just given you a two-decade-long permission slip to change the world.