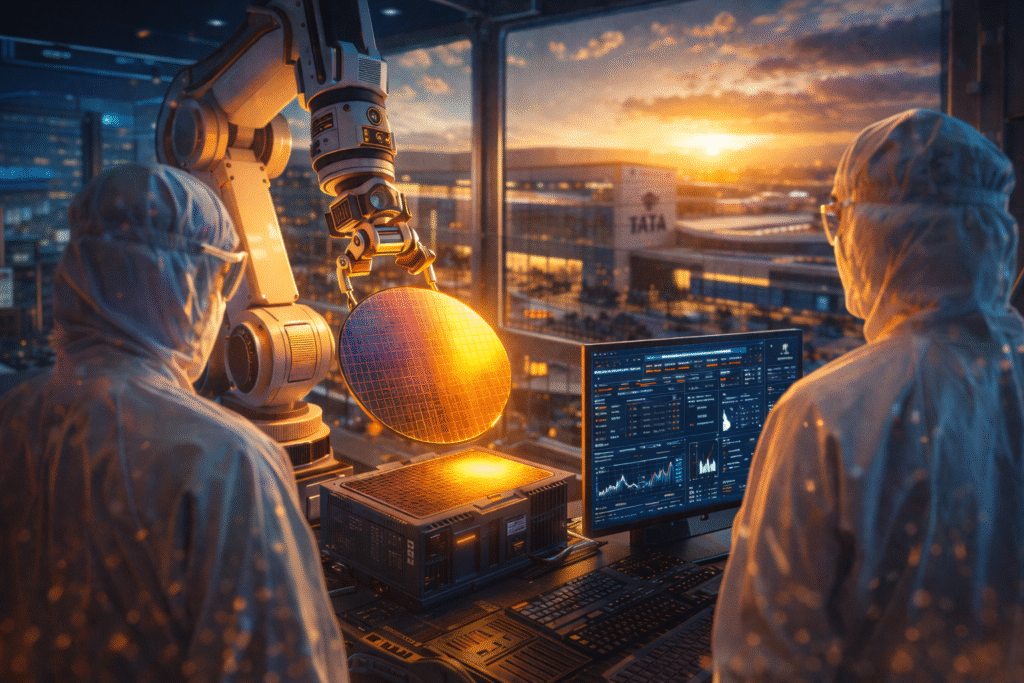

In February 2024, the Indian government greenlit a project that many global analysts called “impossibly ambitious.” Fast forward to February 2026, and the skeptics are silent. While the world faces fractured supply chains, Tata Electronics is on the verge of a historic milestone: the rollout of the first “Made-in-India” semiconductor chip from its Dholera facility by late 2026.

With a staggering investment of ₹1.18 Lakh Crore across two massive units, the Tata Group isn’t just building factories; they are constructing a “Silicon Shield” for the nation. This gamble is the cornerstone of India’s transition from a consumer of high-tech to a global sovereign power in the $1 Trillion electronics economy.

The Problem: India’s “Silent” Vulnerability

The ground reality for decades was a dangerous dependency. India was importing nearly $100 Billion worth of electronics annually, with the most critical component—the semiconductor—entirely sourced from East Asia.

In 2021-22, the global chip shortage halted Indian car production lines and sent smartphone prices soaring. Against all odds, the Indian government and the Tata Group realized that without domestic “fabs” (fabrication plants), India’s digital economy was built on sand. The “Silent” vulnerability wasn’t just economic; it was a matter of national security.

The Pivot/Strategy: The Multi-State “Twin-Fab” Model

Tata’s winning move was to avoid a “one-size-fits-all” approach. They split their strategy into two distinct, high-impact pillars:

- The Dholera “Fab” (The Brain): A ₹91,000 Crore mega-facility in Gujarat, built in partnership with Taiwan’s PSMC. It focuses on the “Golden Node” chips (28nm to 110nm) that power everything from EV power management to 5G infrastructure.

- The Assam “OSAT” (The Muscle): A ₹27,000 Crore assembly and testing facility in Jagiroad. This project is a masterstroke in regional development, taking high-value tech manufacturing to the Northeast for the first time.

How they are winning in 2026:

- Intel as the Anchor: Tata secured Intel as its first major customer, a move that provides instant global credibility and a guaranteed order book.

- Vertical Integration: By using TCS for chip design and Tata Motors for consumption (EVs), the Group has created its own internal demand-supply loop.

The Unit Economics: Scaling the Silicon Dream

The scale of this investment is unprecedented in Indian private sector history.

| Metric | Project Launch (2024) | Current Status (Feb 2026) |

| Total Investment | ₹1.26 Lakh Crore (Govt + Tata) | ₹1.18 Lakh Crore (Tata Committed) |

| Direct Jobs Created | 0 | 50,000+ (Projected) |

| Production Capacity | Planning Stage | 50,000 Wafers/Month |

| Target Revenue Node | N/A | 28nm, 40nm, 55nm, 110nm |

| Supply Chain Impact | Import Dependent | Sourcing 55%+ Indigenously |

The “ForgeUp” Analysis: Why This Model Worked

From a venture studio perspective, Tata’s strategy is a case study in De-risking Deep-Tech. Semiconductor manufacturing is notoriously capital-intensive with long gestation periods.

Tata mitigated this by leveraging the India Semiconductor Mission (ISM) 2.0, which provides a 50% capital subsidy. They didn’t try to compete with high-end 3nm chips (the kind used in iPhones) immediately. Instead, they targeted the “workhorse nodes” used in cars and appliances. This ensures faster market penetration and high-volume demand, creating a stable foundation before moving into cutting-edge 22nm or smaller nodes.

Expert Consensus: What the Industry Says

“Tata is not just building a factory; they are seeding an entire ecosystem. For every direct job in Dholera, ten more will be created in the startup ecosystem building around it.” — Industry Analyst on Budget 2026.

“We are pushing the boundaries of traditional timelines. Our goal is to have chips rolling out by the later part of 2026.” — N. Chandrasekaran, Chairman, Tata Sons.

Also Read: Why and How the New India-US Trade Deal is a Shocking “Duty-Free” Gift for Indian MSMEs

Founder’s Playbook: The Semiconductor Opportunity

- Look for the “Ancillary” Gaps: Don’t try to build a fab. Build the chemicals, specialty gases, or testing software that Tata will need to buy.

- Leverage ISM 2.0: The government has just doubled the outlay for component manufacturing. If you are in deep-tech, now is the time to apply for DLI (Design Linked Incentives).

- Focus on “Dual-Use”: Develop chip-based solutions that can serve both the growing Indian EV market and the strategic Defense sector.

The Bottom Line

Tata’s gamble is the ultimate bet on India’s future. By localizing the heart of the digital world—the chip—they are ensuring that India’s growth is no longer at the mercy of global geopolitical shifts. 2026 isn’t just the year chips roll out; it’s the year India stops being a tech-renter and starts being a tech-owner.

Pingback: Why and How the New India-US GPU Deal is a Shocking "Power Move" for India’s AI Future - ForgeUp – IPOs, Startups & Business News