If you were expecting a rate cut to save your portfolio today, the RBI just gave you a lesson in “Strategic Stability.” On Friday morning, Governor Sanjay Malhotra announced that the Monetary Policy Committee (MPC) has unanimously voted to keep the Repo Rate unchanged at 5.25%.

But don’t let the “Status Quo” fool you. While the headline says “No Change,” the sub-text of today’s speech contains three massive policy shifts that will redefine the Indian economy in 2026.

The “Goldilocks” Economy: Why No Rate Cut is Good News

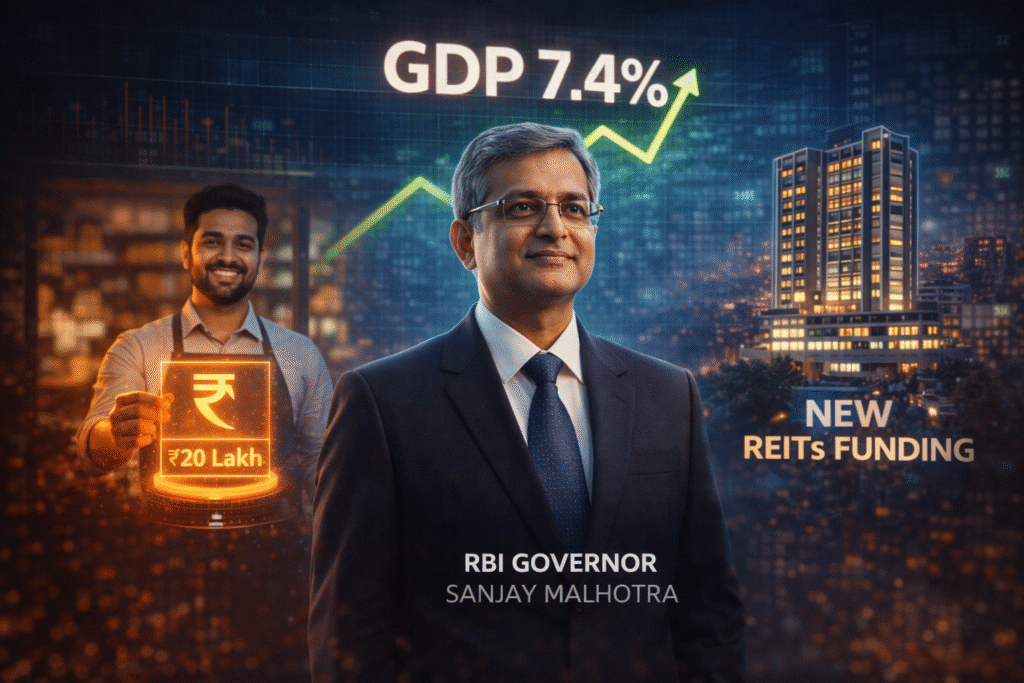

Truth be told, the RBI is playing a very clever game. With the India-US Trade Deal already set to boost GDP by 20 basis points, the Governor has raised India’s growth forecast to 7.4%. The message is clear: India doesn’t need a rate cut to grow right now. We are in a “Goldilocks Zone”—not too hot, not too cold.

The 3 “Hidden” Bombshells from Today’s RBI Speech

| The Policy Move | What Changed? | Who Wins? |

| MSME Boost | Collateral-free loans doubled from ₹10 Lakh to ₹20 Lakh. | Small Business Owners |

| REITs Revolution | Banks allowed to lend directly to Real Estate Investment Trusts. | Property Investors & DLF/Macrotech |

| Fraud Shield | ₹25,000 instant compensation for small-value digital frauds. | The Common Man |

| GDP Forecast | Revised Upwards to 7.4% for FY26. | The Indian Economy |

Why the Market is Bleeding Despite the “Positive” GDP?

Here is the catch: If the news is so good, why is the Sensex down 200 points? The answer lies in the “IT & Pharma” drag. Weakness in the US Nasdaq overnight, combined with a “Sell on News” reaction from institutional investors who were betting on a 0.25% cut, has kept the indices under pressure.

However, “Rate Sensitive” sectors like Real Estate are holding firm. The new rule allowing banks to fund REITs is a massive liquidity booster for the property market, making it easier for large developers to refinance debt.

What the Analysts are Saying

“The RBI has moved from ‘Inflation Fighting’ to ‘Growth Guarding.’ By doubling the MSME loan limit, they have effectively finished the job the Budget started. We expect the Nifty to consolidate at 25,600 before the next leg of the rally toward 27,000,” says Dhiraj Relli, MD & CEO of HDFC Securities.

Pro-Tip: The “Digital Safety” Trade

The Governor’s focus on a ₹25,000 fraud compensation framework is a huge signal for Fintech companies. Watch stocks like Paytm and PB Fintech (PolicyBazaar). This regulatory clarity makes digital payments safer, which will drive massive volume growth in rural India over the next 6 months.

The Bottom Line

The February 2026 RBI Policy is a “Growth-First” document. By keeping rates at 5.25% but easing loan norms for MSMEs and REITs, the central bank has ensured that the “engine” of the economy stays greased without risking a spike in inflation. For the smart investor, today’s “Red” screen is a “Golden” buying opportunity in Real Estate and MSME-lending NBFCs.