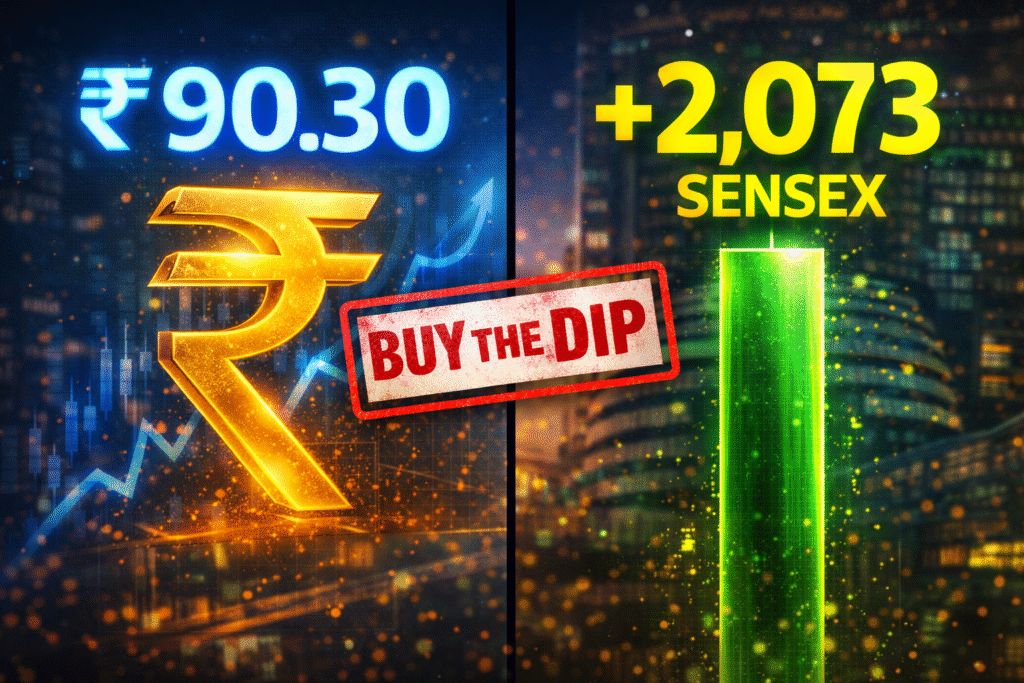

If you thought the Budget 2026 carnage was going to last, the last 24 hours just proved you wrong with a ₹20 Lakh Crore recovery. The truth is, while the “Common Man” was worried about the STT hike, the Rupee just posted its best gain since 2018, surging 119 paise to hit 90.30 against the dollar.

The Shocking Turnaround: Why the Rupee and Sensex Exploded

The market didn’t just “bounce”—it staged a violent reversal. The BSE Sensex closed a massive 2,073 points (2.54%) higher at 83,739, while the Nifty reclaimed the 25,700 mark with ease.

The catalyst? A historic “midnight deal” between PM Modi and President Trump that slashed US tariffs on Indian goods from 50% to 18%. This single move wiped out the “tariff overhang” that had kept Foreign Institutional Investors (FIIs) on the sidelines for months. As FIIs scrambled to cover their shorts, the influx of dollar promises sent the Rupee jumping from 91.49 to 90.30, making it one of the strongest currencies in Asia today.

The “Trade Deal” Recovery: Old vs. New Market Reality

| Metric | Pre-Deal (Feb 2, 2026) | Post-Deal (Feb 3, 2026) | Market Impact |

| Sensex Level | 81,666 | 83,739 | +2,073 Points |

| Rupee vs Dollar | 91.49 | 90.30 | 119 Paise Jump |

| FII Activity | Net Sellers (₹1,832 Cr) | Aggressive Short Covering | Liquidity Surge |

| US Tariff on India | 50% (Penal) | 18% | Export Boom Confirmed |

How the Surge Creates a “Buy the Dip” Window in Banking and IT

Here’s the catch: While the “Headline Indices” are flying, the two sectors that were most beaten down in January—Banking and IT—are now offering a “Secret Blueprint” for wealth creation.

1. Banking: The Credit Growth Engine

The Banking sector (Bank Nifty) has been under pressure due to the government’s record debt-sale program. However, with the India-US trade deal, analysts expect a massive surge in Export Credit and Corporate Capex.

- HDFC Bank & ICICI Bank: These heavyweights led the 2,073-point charge today.

- The Opportunity: With the Rupee strengthening, imported inflation cools down, giving the RBI more room to pause or even cut rates later in 2026. Any minor dip from here is a “Lakh-Crore” opportunity to enter quality private banks.

2. IT Services: The H-1B & Tariff Relief Play

The IT sector was terrified of a “Trade War.” Now, with the reciprocal tariff set at a manageable 18%, that fear has evaporated.

- Infosys & Wipro: Both stocks surged significantly (with Infosys ADR up 4.3% overnight).

- The Opportunity: The IT index is still below its all-time highs. As US companies commit to $500 Billion in tech and energy purchases from India, the “Order Pipeline” for Indian IT firms for FY 2026-27 is looking more robust than ever.

What the Analysts are Saying

The consensus on Dalal Street is that the “Budget Bottom” is firmly in place.

- Anil Kumar Bhansali (Finrex Treasury): “The 119-paise jump in the Rupee changes the entire narrative. FIIs who were sitting on the sidelines are finally seeing India as a ‘Safe Haven’ compared to other emerging markets.”

- Kotak Securities: Analysts suggest that while the STT hike was a “tactical” blow, the trade deal is a “structural” blessing. They expect the Nifty to test 26,500 before the end of the quarter.

- The Consensus: The combination of a strong Rupee and slashed US tariffs has effectively canceled out the negativity of the Budget 2026 tax tweaks.

💡 Pro-Tip: The “FII Entry” Signal

Keep an eye on the USD-INR NDF (Non-Deliverable Forward) market. If the Rupee sustains below 90.50 for three consecutive sessions, it will trigger a “Green Light” for global macro funds to pour billions into Indian Large-caps.

The Bottom Line

The 2,073-point Sensex surge and the 119-paise Rupee jump are a “Warning” to the bears: the India-US partnership is now the market’s primary driver. If you missed the initial 1,200-point Nifty gap-up, the current consolidation in Banking and IT is your “Buy the Dip” window. Don’t wait for the Rupee to hit 89; the smartest money in the world is already moving back to Mumbai.